When you hear the phrase “money behind escort girls,” you probably picture glamorous nightclubs, high‑end hotels, and sky‑high price tags. The reality is more nuanced: earnings depend on a mix of location, experience, whether an escort works independently or through an agency, and even the payment methods they accept. Below you’ll find a plain‑spoken breakdown of how much escort girls actually make in the UK, what factors push the numbers up or down, and practical tips for anyone curious about the economics of this part of the sex‑work industry.

Quick Takeaways

- UK escort earnings vary widely - from £150 hour for newcomers to £800 hour for top‑tier independent escorts.

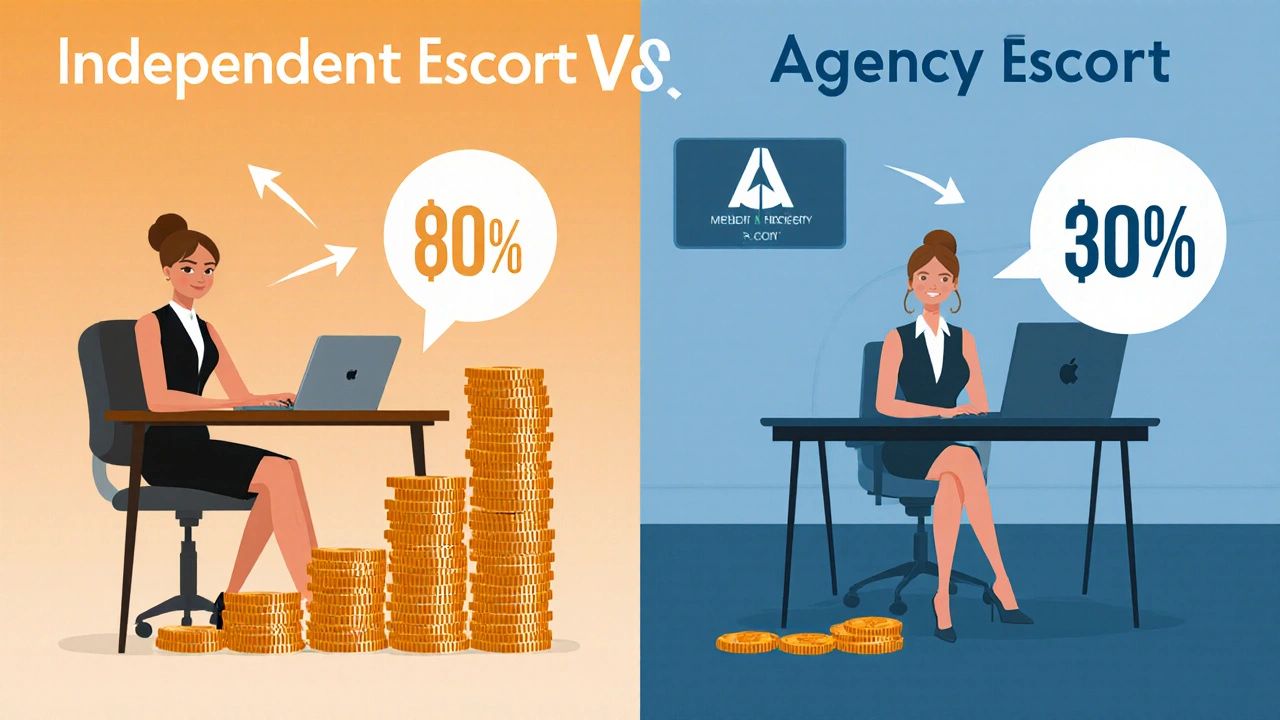

- Independent escorts keep 80‑90 % of their fees; agencies typically take 20‑30 % commission.

- Hourly rates are just a baseline - many earn extra via private meetings, travel fees, and premium services.

- Cash, bank transfers, and encrypted payment apps are the most common methods, each with its own safety considerations.

- Legal compliance (e.g., registration with local authorities) can affect both earning potential and risk.

Comprehensive Guide to Escort Earnings in the UK

Let’s start with the big picture. In the UK, escort work sits under the broader umbrella of Sex Work - the range of consensual activities where individuals provide intimate services for compensation. While the exact figures can be elusive-many workers prefer privacy-the industry has enough public data to sketch realistic ranges.

Definition and Context

An Escort Girl - a woman who offers companionship, conversation, and often intimate encounters for a fee, typically arranged through agencies or personal networks is distinct from broader sex‑work categories like street prostitution or adult camming because the service is marketed as a premium social experience. The focus on companionship, discretion, and personal presentation allows many escorts to command higher rates than other forms of sex work.

Benefits of Understanding Escort Earnings

Knowing the financial landscape does more than satisfy curiosity. It helps potential clients set realistic expectations, guides aspiring escorts in choosing the right business model, and informs policymakers and advocates about the economic realities that shape safety and legal needs. For example, a clear view of how commissions affect net income can influence an escort’s decision to go independent, potentially increasing earnings while demanding stronger self‑management skills.

Types of Escort Services Available in the UK

In the UK, the market splits mainly into two categories:

- Independent Escort - works freelance, sets her own rates, and handles bookings directly with clients.

- Agency Escort - operates through a third‑party agency that manages advertising, client screening, and logistics in exchange for a commission.

Both models exist across major cities-London, Manchester, Birmingham-and even in smaller towns, but the earnings profile differs considerably.

How to Find Escort Services in the UK

Finding a reputable escort starts with reputable platforms. Popular avenues include:

- Specialised escort directories (e.g., Escorts UK, London Escort Guide) that list verified profiles.

- Social media and encrypted messaging apps where independent escorts showcase portfolios.

- Word‑of‑mouth referrals within adult‑entertainment circles.

When using directories, look for clear contact information, professional photos, and an explicit policy on privacy. Avoid sites that demand upfront cash without any verifiable references.

What to Expect During a Session

A typical session begins with a brief consultation-phone or chat-where the client and escort confirm boundaries, duration, and any special requests. Most sessions last between one and three hours, though premium “overnight” arrangements are also offered. Extras such as travel, role‑play, or exclusive venues can add 20‑40 % to the base rate.

Pricing and Booking

The simplest way to understand pricing is to break it into three layers:

- Base Hourly Rate: Ranges from £150 hour for newcomers to £800 hour for elite independent escorts in London.

- Commission or Fees: Agencies usually keep 20‑30 % of the fee; independents retain 80‑90 % after payment‑processor costs.

- Additional Charges: Travel (£30‑£100), premium services (£50‑£300), and last‑minute bookings (extra 10‑15 %).

Booking is typically done through a secure form on the escort’s or agency’s site, followed by a payment method of the client’s choice. Many escorts now require a deposit to secure the appointment.

Safety Tips for Clients and Escorts

Safety matters for both sides. Here are a few universally accepted practices:

- Verify the escort’s identity through a video call before the meet‑up.

- Use reputable, encrypted payment apps (e.g., Revolut, Bitcoin mixers) to protect financial data.

- Never share personal address; meet in a neutral, public place first.

- Both parties should agree on a “safe word” to pause or end the encounter instantly if needed.

For escorts, having a clear Legal Framework - the set of local laws and regulations governing adult‑service businesses-including registration with the local council in places like London’s Soho district-helps reduce legal risk and can improve client trust.

Comparison Table: Independent Escort vs. Agency Escort in the UK

| Aspect | Independent Escort | Agency Escort |

|---|---|---|

| Net Earnings % | 80‑90 % | 70‑80 % |

| Commission Rate | None (self‑managed) | 20‑30 % to agency |

| Rate Flexibility | High - can set custom prices per client | Medium - agency sets standard rates |

| Marketing Support | Self‑promoted (social media, directories) | Agency handles ads, SEO, client screening |

| Safety Services | Self‑managed - must vet clients | Agency often offers background checks |

| Legal Compliance Assistance | Dependent on self‑research | Agency may provide guidance |

FAQ: Your Questions About Escort Earnings Answered

How much does a typical escort earn per hour in London?

Entry‑level escorts usually start around £150‑£250 per hour, while seasoned independents can command £500‑£800 per hour, especially for niche services or premium clientele.

Do escorts get paid in cash or through banks?

Both. Cash remains common for discretion, but many now accept bank transfers, e‑wallets (e.g., Revolut, PayPal), and even cryptocurrencies to avoid traceability.

What costs do agencies charge?

Agencies typically keep 20‑30 % of the client fee as commission. Some also charge a flat registration fee or a per‑session service charge.

Is escort work legal in the UK?

Yes, as long as it’s conducted consensually and without brothel‑keeping. Independent escorts must still abide by local licensing rules, especially in council‑regulated zones like Soho.

Can an escort increase earnings without switching to an agency?

Absolutely - by improving personal branding, offering premium add‑ons, and targeting high‑spending clients, many independents boost net income by 30‑50 % while keeping control over schedule.

Take the Next Step

If you’re curious about trying out this line of work, start by researching reputable directories, setting a realistic base rate, and building a secure payment pipeline. For clients, the key is clear communication and respecting the escort’s professional boundaries. Either way, understanding the money side of escorting demystifies the industry and helps everyone make smarter, safer choices.

7 Comments

Tom Garrett

The financial arteries that sustain escort services are far more entangled than the glossy brochures would admit. Behind each advertised rate lies a network of shadowy intermediaries, from offshore shell corporations to encrypted payment processors, that siphon off a portion of the earnings before the escort even sees a penny. This hidden choreography is orchestrated by what I can only describe as a clandestine syndicate that thrives on the very anonymity the industry cherishes. Their influence reaches into the very platforms that claim to provide safe, regulated listings, embedding back‑doors that allow data to be harvested and sold on the dark web. Consequently, the nominal £800 per hour quoted for elite independents is often a mirage, as the actual net income can be eroded by undisclosed fees that are masked under the guise of “security charges.” The agencies themselves act as both gatekeepers and tax collectors, extracting a commission that is officially stated as 20‑30 % but, in practice, can swell to nearly half of the gross fee once hidden processing costs are included. Moreover, the payment methods favored by many escorts-cash, crypto mixers, and obscure e‑wallets-are deliberately chosen to evade traditional banking oversight, which in turn feeds the black‑market channels that profit from every transaction. It is not a coincidence that many of the most successful independent escorts also maintain multiple bank accounts under different identities, a strategy that mirrors the tactics employed by illicit money‑laundering rings. When one examines the flow of funds from client to escort, the trail often disappears at the point where a so‑called “deposit” is transferred to a third‑party escrow service that is, in reality, a front for a larger laundering operation. These escrow services claim to protect both parties, yet they hold the power to freeze or redirect funds with a single command, creating a lever of control that mirrors the leverage held by organized crime syndicates. The legal landscape in the UK, with its patchwork of licensing requirements and ambiguous enforcement, provides fertile ground for these hidden actors to operate with impunity. Local councils that register certain districts for adult‑service businesses inadvertently create a registry that can be exploited for tax evasion and money‑laundering purposes. In addition, the very act of requiring escorts to register can be weaponized, as data breaches have already exposed the identities of hundreds of workers, leading to blackmail schemes that further divert earnings into the pockets of extortionists. All of these mechanisms combine to form a covert economy that is as much about power and secrecy as it is about the advertised rates on a glossy website. The average client remains blissfully unaware that the money they hand over is being funneled through a labyrinth of hidden fees, offshore accounts, and possibly even state‑sanctioned surveillance programs. In short, what appears on the surface as a straightforward transaction is, in reality, a multi‑layered financial conspiracy that benefits a select few while the escort bears the brunt of the cost and the risk.

Eva Ch

Indeed, the delineation between cash transactions and encrypted digital payments warrants a thorough examination; while cash preserves anonymity it also introduces risks associated with physical handling, whereas platforms such as Revolut or cryptocurrency mixers provide a veneer of discretion coupled with traceability mitigation, albeit sometimes at the expense of regulatory compliance; consequently, escorts are advised to diversify their payment portfolio, ensuring that each method aligns with both personal safety protocols and legal obligations, and to maintain meticulous records for tax reporting purposes.

Julie Corbett

The economic model presented herein is fundamentally sound. However the omission of variable overhead costs such as venue rental and personal security yields an inflated perception of net earnings. A calibrated approach that subtracts these expenditures from gross revenue offers a more authentic representation of profitability.

Gerald Matlakala

One must consider, of course, that the very platforms advertising escort services are frequently compromised, infiltrated by state‑run surveillance agencies, and leveraged to funnel illicit capital into shadow economies; this is not speculation but a pattern observed across multiple jurisdictions, where encrypted payment apps are subtly monitored, and where the veneer of “privacy” disguises a deeper orchestration of financial control.

Vaishnavi Agarwal

It is deeply troubling that society turns a blind eye to the exploitation embedded within this industry; while some celebrate personal freedom, the truth remains that many escorts are coerced by economic desperation, forced to navigate a perilous landscape that prioritizes profit over human dignity; we must therefore demand stricter safeguards and ethical standards to protect those who are unjustly commodified.

Kirsten Stubbs

The United States enforces stringent regulations that protect workers; adopting similar standards here would curb exploitation.

Sara Roberts

dont think its right.